Mileage Log Form Driver For Mac

Multipart article

A well-maintained mileage log can make a huge difference for salespeople, service workers, or anyone who spends a significant time on the road for their job, especially if you are self-employed. Those miles translate into dollars, either as reimbursement from your employer or as a deduction from the IRS, and they can add up quickly. You can simplify the task of keeping these expenses in order by using mileage templates. The free, easy-to-use, and customizable templates below track vehicle maintenance, gas mileage, and more transportation-related expenses, and they’re available for download as Microsoft Excel and Word, PDF, or Google Docs files.

Mileage tracking is not only important for tax returns for employees but small business owners, nonprofit organizations and other non-reimbursed businesses. Money can be easily saved if little bits of information like this are properly filed and managed for each month or year. A mileage log form is simple and easy to use for each person.

What Is a Mileage Log?

A mileage log provides a record of vehicle miles traveled for business over a given time period. This documentation may be used to collect reimbursement from an employer or to claim mileage as a tax deduction. Mileage logs may also be used to keep track of other deductible miles, such as those related to travel for medical appointments, when moving, or as part of work for charitable organizations. Employers may set their own reimbursement rates, while the IRS updates mileage rates each year for taxpayers to follow.

If you plan to deduct miles on your tax return, it’s important to keep track of mileage on a daily basis and maintain accurate records in case of an audit. A mileage log could be any form, spreadsheet, or online application that helps you keep track of miles.

Mileage Report Templates

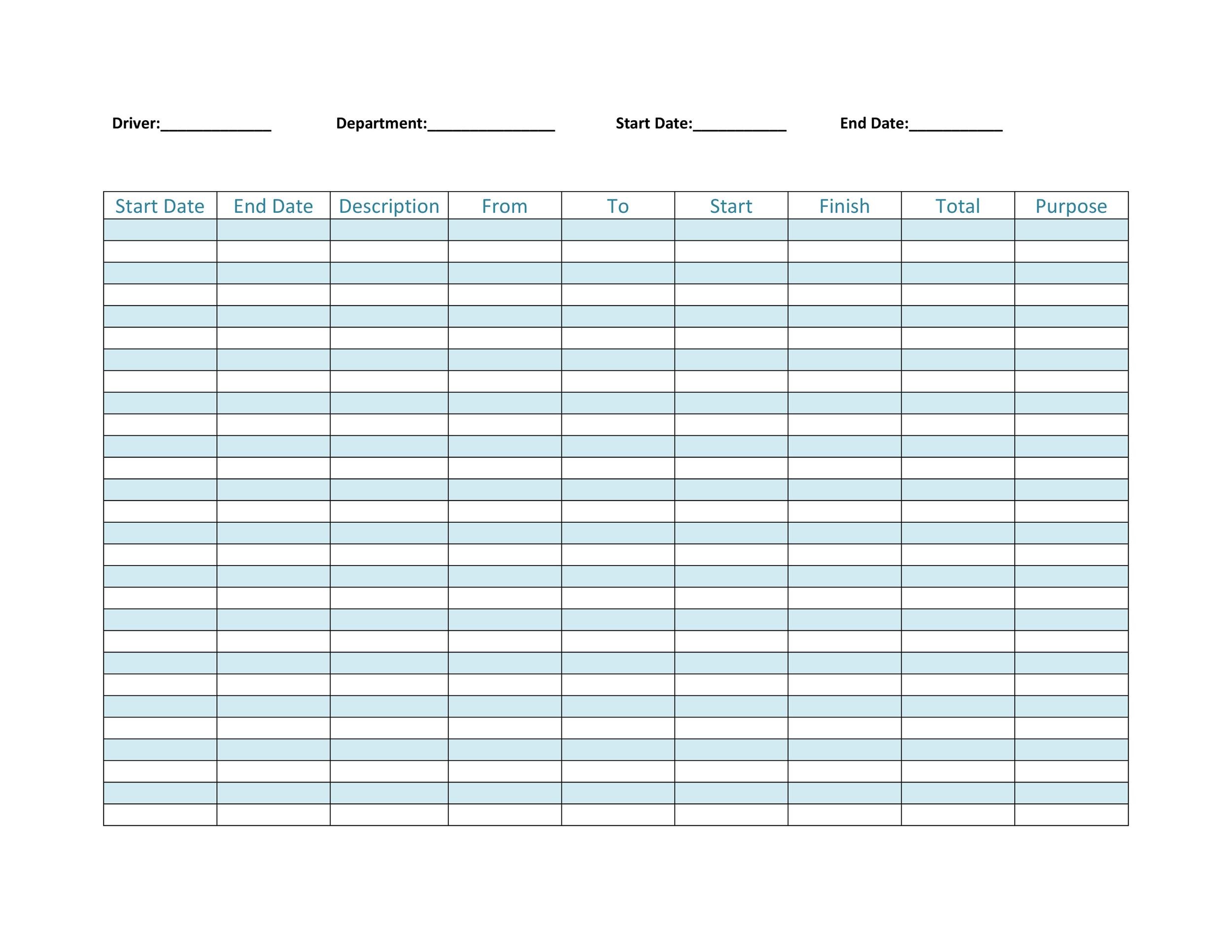

Business Vehicle Mileage Log

This Excel mileage log provides a simple layout for easy mileage reporting and automatic calculations for daily miles, total miles, and reimbursement amounts. It includes columns to list the date and purpose of a trip, odometer start and finish readings, and relevant notes about trip details, which can provide important documentation during an audit. Use this template as a daily and monthly mileage log.

12-Month Mileage Log Spreadsheet

Each month gets its own mileage log sheet in this template, so you can record daily, monthly, and yearly miles. Keep track of your overall mileage as well as business miles that can be deducted. In addition to monthly log sheets, the template provides an annual mileage summary so that you can get a quick overview. This template can easily be edited to track other information, such as tolls and other fees, or personal miles that can be deducted, such as expenses related to moving or medical appointments. Save this Google Sheets log to your Drive account for cloud storage and easy access from a mobile device.

Monthly Mileage Report Form

This monthly mileage report template can be used as a mileage calculator and reimbursement form. Template features include sections to list starting and ending locations, daily and total miles driven, employee information, and approval signatures. This spreadsheet report can be customized to include whatever details are relevant to your business, including mileage rates. It’s available as an Excel, Word, or PDF file.

Download Monthly Mileage Report Form Template

Excel Word PDF

More Log Templates: Weekly Expenses, Gas Mileage, and Vehicle Maintenance

Weekly Expense Report Template

More than just a mileage expense report, this template can be used for tracking other business travel expenses for reimbursement on a weekly basis. Enter company and employee information at the top along with a time period, and then keep track of mileage and other expenses for each day of the week. This is a detailed template that allows you to create a thorough expense report for accounting and record keeping.

Gas Mileage Log Form

If you’re keeping track of business-related gas expenses, this gasoline log can calculate the cost of a trip based on the distance traveled, the price of gas, and your vehicle’s gas mileage. This is useful both for anticipating the cost of a trip and for tracking actual expenses. Use this template for your own personal budgeting or to support tax documentation along with receipts.

Vehicle Maintenance Log Template

Keep track of vehicle maintenance, repairs, and related expenses with this log template for Google Sheets. Get a quick view of services performed over the course of a year, along with itemized and total costs. Combine this with invoices and receipts to help organize your records. Keep a printed version in your vehicle for a reminder of what services have been completed.

What Business Driving Can Be Deducted?

The most likely candidates for deducting business miles are self-employed individuals who use their vehicles for work purposes. Employees may also be able to deduct part of the cost of mileage if their employers are not reimbursing them at the full rate set by the IRS. However, no taxpayer can deduct mileage for commuting to and from work.

In addition to tracking the number of miles driven, you also need to document the purpose of business travel. Here are some types of business vehicle use that are allowable for mileage deductions:

- Driving from one work location to another, such as an office or other work site

- Visiting customers or clients

- Going to a business meeting that is away from one’s workplace

- Traveling to a temporary workplace

You may also be able to deduct mileage for job-related errands, such as picking up supplies, and for business entertainment. Keep in mind that certain variables may affect how a deduction needs to be claimed, including whether a work location is within your home area or if the travel involves an extended overnight stay. Check the current IRS rules or consult with a tax accountant to ensure that your deductions are accurate and allowable.

Standard Mileage Deduction vs. Actual Expenses

Taxpayers can choose to take a standard mileage deduction by multiplying the number of qualified business miles by the IRS mileage rate. In addition to this standard amount, they may be able to deduct tolls and parking fees that are related to business travel.

Alternatively, taxpayers can choose to deduct actual expenses they accrued over a given year, including business costs related to vehicle depreciation, registration fees, lease and insurance payments, gas, repairs, tolls, and other expenses. When deducting actual expenses, it’s important to keep receipts and other supporting documentation.

A mileage log can be used to track both business and personal miles in order to show what percentage of vehicle use is work related. Again, check with the IRS or your tax preparer to get the most accurate and up-to-date rules for tax deductions each year.

What Is the Mileage Reimbursement Rate for 2017?

The standard mileage rates set by the IRS fluctuate from year to year. For 2017, the rate per mile for deducting business travel is 53.5 cents. For miles accrued as part of charitable work, the rate is 14 cents per mile. And for mileage related to medical or moving purposes, the rate is 17 cents per mile.

What Is the Mileage Reimbursement Rate for 2018?

In 2018, the standard mileage rates increased slightly from those in 2017 for travel related to business, medical, or moving needs. For business miles driven, the rate is 54.5 cents per mile. For medical and moving mileage, the rate is 18 cents per mile. And for charitable mileage, the rate is the same as the previous year, at 14 cents per mile.

For more information, see this quick overview of standard mileage rates from the IRS.

Using a Mileage App: Pros and Cons

Several apps, such as MileIQ, Quickbooks Self-Employed, and TripLog, are designed for calculating and tracking mileage. These apps offer the benefit of automatic mileage tracking using GPS, so drivers can simply rely on the app to detect routes and add up miles. Some apps also calculate other expenses and allow you to categorize the type of trip in order to separate personal and business miles.

Playing a game from a USB drive requires you to, which voids your Wii's warranty and violates Nintendo's terms of use. Keep in mind that this works on the classic Wii, but not the Wii U. This wikiHow teaches you how to play a Wii game from a file that's stored on a USB flash drive rather than on a disc. Wii u homebrew game download.

However, this convenience comes with drawbacks, including cost. Prices vary, but a fee is often required to get the benefit of automatic mileage tracking. Another potential con is the amount of storage space required to support one of these apps, which may clog up your phone quickly and wear down the battery. Before you opt for an online mileage service, be sure to read through user reviews to get a better idea of what to expect, how well they work, and whether the cost is worth the potential hassle.

Mileage Tracking Tips

Keeping track of mileage is important and doesn’t have to be overwhelming. Here are a few tips for creating an easy process while maintaining accuracy.

- Calculate mileage daily. This can’t be emphasized enough. Try to make it a daily habit so that your records are accurate and detailed, and nothing is overlooked. This may be especially important if you are audited.

- Use maps as a backup. Humans make mistakes, and mileage apps can have their own issues. If you use your vehicle for business and forget or lose the mileage information, look up the route with an online map to estimate the miles traveled, and then print a copy for documentation.

- Hold on to your mileage records. The IRS recommends holding on to mileage logs and other supporting documentation for at least three years. To help ensure that records are not lost, consider keeping digital versions in a safe and easily accessible location.

- Keep a paper log in your car: A paper copy of your mileage log can serve as a backup if technology fails or if you think of a note during your trip that you want to add to a digital log at a later time.

No matter how you track your business miles or store your records, aim for accuracy so that you’re not missing out on deductions and the full reimbursement amount you are owed.

Manage Your Mileage and Business Expenses Better in Smartsheet

You can’t always avoid work-related travel, but you can manage it and — more important — make sure you’re compensated for mileage and other related expenses. The key is to stay on top of the numbers, both on your odometer and your credit card. Organization is important, and Smartsheet is a powerful tool to help track and manage your work, resources, budget, and other project details in real time.

Smartsheet is an enterprise work management platform that is fundamentally changing the way businesses and teams work. Over 74,000 brands and millions of information workers trust Smartsheet to help them accelerate business execution and address the volume and velocity of today's collaborative work.

The familiar Smartsheet interface that is designed for how people actually work leads to rapid and broad adoption across your organization. Use self-service reports and dashboards in Smartsheet to provide real-time visibility into resources, status, and performance, so you can rapidly align operations with strategy.

Discover why millions of professionals around the world use Smartsheet to move from idea to impact — fast.